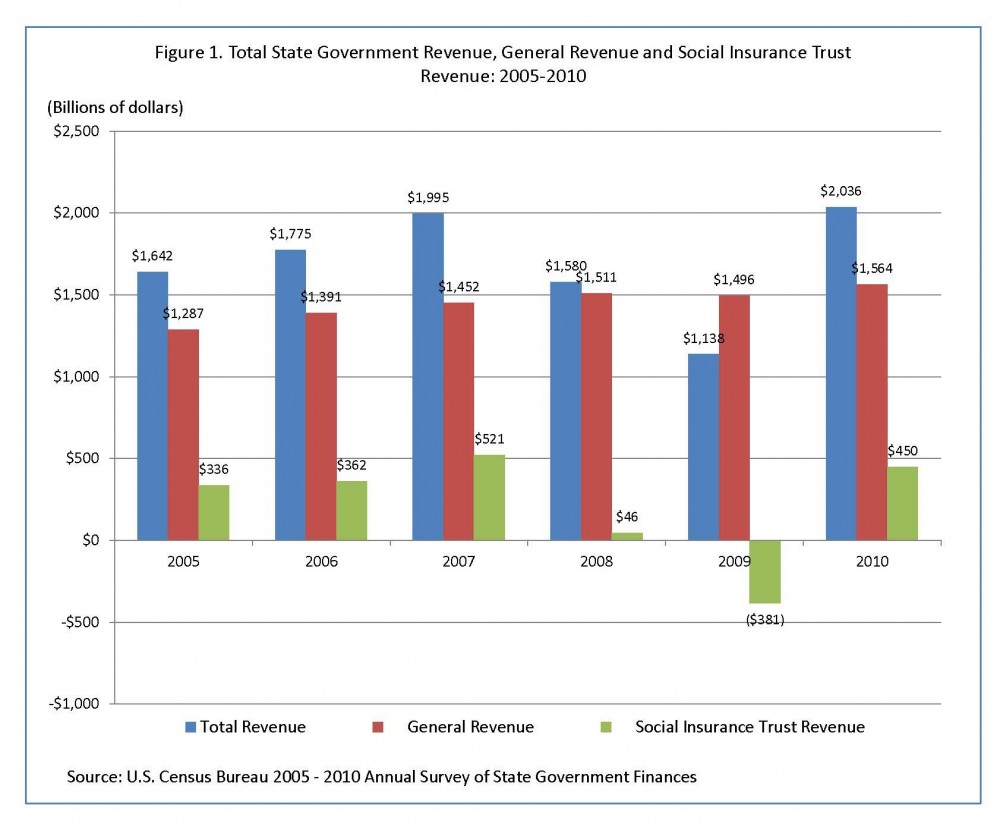

Total state government revenue increased to $2.0 trillion in 2010, up 79.0 percent from $1.1 trillion in 2009, resulting mainly from large increases in social insurance trust revenue, according to the latest findings from the U.S. Census Bureau. After a substantial loss in earnings in 2009, trust systems showed earnings of $450.5 billion in 2010, a gain of 218.2 percent over the year before.

Two major sources make up these trust systems: (1) employee retirement systems and (2) federal and state social insurance trust systems, which include the unemployment compensation system, state government worker’s compensation programs, Social Security, Medicare, veteran’s life insurance and railroad retirement.

Earnings on these systems vary widely year to year because state retirement systems invest heavily in financial markets and respond to shifts in market performance. More detailed statistics about the state retirement systems will be available with the upcoming state retirement data release in the first quarter of 2012.

Nonetheless, state government budgets depend mostly on revenue from general sources – taxes, federal grants, service charges and other miscellaneous revenues. (See figure 1.) General revenues fund most state programs and in general comprise most of the state governments’ revenue (76.8 percent in 2010).

“General revenue helps state governments fund basic services, such as education, police protection, social services, highway improvements, health and hospitals and the like,” said Lisa Blumerman, chief of the Census Bureau’s Governments Division. “In 2010, general revenue amounted to $1.6 trillion, representing a 4.5 percent increase in available funds from 2009. This growth in general revenue indicates that states were able to raise limited additional funding in 2010, whether it be through the collection of taxes, charges, or receipt of additional federal monies, to provide continued services for their constituents.”

General Revenues

State government taxes collected in 2010 ($702.2 billion) accounted for 44.9 percent of general revenue, a drop of 1.9 percent from $715.5 billion in 2009. Federal grants ($555.3 billion) increased 16.7 percent from 2009 to 2010 and accounted for 35.5 percent of general revenue.

Federal grants for welfare programs comprised 56.8 percent of all federal grants received in 2010, increasing 12.2 percent to $315.5 billion. Increases in 2010 in part were because of American Recovery Reinvestment Act (ARRA) funds. The accompanying table shows total federal revenue and federal grants for welfare, with associated ratios for all 50 states for 2010 and 2009.

Service charges (excluding those for utilities) collected in 2010 ($169.6 billion) rose by 5.2 percent from $161.2 billion in 2009. Service charges accounted for 10.8 percent of general revenue.

State Government Expenditures

General expenditures by state governments rose 2.4 percent in 2010. These expenditures totaled nearly $1.6 trillion, with expenditures for education ($571.0 billion), public welfare ($462.7 billion) and health and hospitals ($123.6 billion) representing the top three activities.

State government spending on public welfare was greater than 30 percent of general expenditures in 12 states, led by Tennessee (38.1 percent), Rhode Island (36.7 percent) and Maine (36.7 percent.)

State government spending on education totaled more than 40 percent of general expenditures in 14 states, led by Indiana (46.6 percent), Georgia (46.3 percent) and Texas (45.6 percent). The accompanying table shows general expenditure and education expenditure, with associated ratios for all 50 states for 2010 and 2009.

The leading states in spending for highways, as a percentage of general expenditures, were Alaska (14.9 percent), South Dakota (13.3 percent) and North Dakota (12.7 percent).

Hawaii (11.9 percent) led in spending on public health and hospitals as a percentage of general expenditures, followed by Alabama (11.0 percent) and Missouri (11.0 percent).

For the 43 states with lotteries, ticket sales totaled $53.1 billion in 2010, compared with $52.3 billion in 2009. Lottery prizes awarded totaled $32.8 billion, and lottery proceeds were $17.8 billion.

The top three states in lottery ticket sales were

- New York ($6.9 billion),

- Massachusetts ($4.2 billion)

- Florida ($3.7 billion).

The same states also ranked highest in prizes awarded: New York ($4.0 billion), Massachusetts ($3.2 billion) and Florida ($2.3 billion).

These findings come from the 2010 Annual Survey of State Government Finances ( http://www.census.gov/govs/state/ ), which reports revenues, expenditures, debt, and cash and security holdings for each state as well as a national summary.

The data on state government finances for fiscal year 2010 and past years are available on the Internet in viewable and downloadable files www.census.gov/govs/state

The data in these tables are from a census of governments, therefore they are not subject to sampling variability, but are subject to coverage, response and processing errors as well as errors of non-response.

For more information on the data limitations, definitions and methodology, see www.census.gov/govs/state/how_data_collected.html